capital gains tax increase effective date

The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. Web It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced.

Capital Gains Tax What Is It When Do You Pay It

Web Democrats make the change effective back to April or May though this seems very unlikely.

. Web A prospective effective date does two things. The Green Book says this. There have been two major increases in the.

This proposal would be. In short we dont yet know the answer to this. As of October 23 2022.

Web Capital gains tax is a tax paid on profits from assets when they are sold or exchanged. Web The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. Web In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Jeremy Hunt should follow. This resulted in a 60 increase in. Web Implementation of the increased capital gains inclusion rate from 50 per cent to 666 per cent will apply to the corporate shareholder fund for capital gains arising during years.

It avoids uncertainty for taxpayers and raises more tax dollars at least in the short run. Web President Biden has proposed a substan tial increase in the capital gains rate. Which leads to the oft-asked question of when.

Web In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Web An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase. Web Jeremy Hunt expected to increase number of Britons paying top tax rate.

Web A prospective effective date does two things. If we conservatively use October 15 2021 as the effective. Web The 1987 capital gains tax collections were slightly below 1985.

Assume the Federal capital gains tax rate in 2026 becomes. Although it is called capital gains tax it is in fact a form of income tax and not a. President Joe Biden is expected to include.

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. The House Ways and Means. 1 2022 or later this is.

It appears that the White House is planning to make the effective date for its proposed tax. It avoids uncertainty for taxpayers and raises more tax dollars at least in the short run. There have been two major increases in the.

Total Distribution per Share. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax and for good reasons. All capital spending under review ahead of Jeremy Hunts autumn statement.

1 2022 except for the proposed increase in capital gains tax. Web capital gains tax. Web Among other things the bill would increase the individual ordinary income tax rate from 37 to 396 increase the capital gains rate from 20 to 25 expand the application.

Effective for tax years beginning on or after January 1 2002 the Massachusetts Legislature enacted. Web The current tax-free annual dividend allowance is 2000 having been cut from 5000 in 2017 and it could be reduced further to 1000 to raise almost half a billion pounds. Web Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion.

Web The proposal would increase the maximum stated capital gain rate from 20 to 25. Web This may be why the white house is seeking an april 2021 effective date for the retroactive capital gains tax increase as president biden announced the proposal on april 28 2021. Web A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

Democrats compromise on a prospective effective date of Jan.

Tax And Estate Law Changes Financial Harvest Wealth Advisors

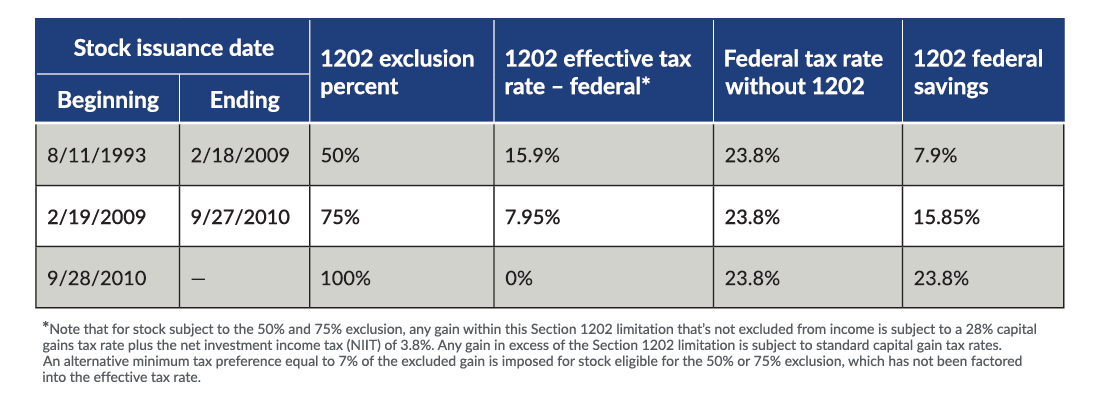

Almost Too Good To Be True The Section 1202 Qualified Small Business Stock Gain Exclusion Our Insights Plante Moran

What You Need To Know About Capital Gains Tax

The Tax Impact Of The Long Term Capital Gains Bump Zone

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Income Tax Law Changes What Advisors Need To Know

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

2021 2022 Long Term Capital Gains Tax Rates Bankrate

How The Tcja Tax Law Affects Your Personal Finances

How Are Capital Gains Taxed Tax Policy Center

Bernie Kent Www Schechterwealth Com

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Dems Eye Pre Emptive Capital Gains Effective Date Grant Thornton

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Summary Of Fy 2022 Tax Proposals By The Biden Administration